Home Loan in Dehradun : How to Apply, Compare Interest Rates Complete Guide 2025

Buying a Dream home in Dehradun, one of India’s most peaceful and beautiful cities, is a dream for many people. Whether you are a first-time buyer or want to invest in property, finding the right home loan in Dehradun at affordable rates is important. In this blog, we will help you explore the lowest home loan rates in Dehradun, connect you with the best loan agents, and answer your main questions about getting a home loan in the city.

Why Build Your Dream Home in Dehradun?

Dehradun, the capital of Uttarakhand, offers a great mix of natural beauty, modern infrastructure, and peaceful living. Its pleasant climate and strong educational and healthcare facilities make it a popular choice for homebuyers seeking a calm yet well-connected place to live. Whether you’re thinking about a retirement home, a family house, or a holiday retreat, building your home in Dehradun is a smart investment for improved quality of life.

Dehradun offers:

- Serene environment and pleasant weather.

- Rapid infrastructure growth.

- Close to major cities like Delhi and Haridwar.

- Affordable property rates when compared to metro cities.

As the city grows, so does the demand for home loans in Dehradun, making it essential to find the right financial partner and best possible interest rates.

Lowest Home Loan Interest Rate In Dehradun

Getting the lowest home loan interest rates in Dehradun can help you save a lot over your loan period. Right now, several banks and NBFCs provide competitive home loan interest rates starting from 7.25%. These rates depend on your credit score, loan amount, and ability to repay.

Factors Affecting Home Loan Interest Rates in Dehradun:

- Your CIBIL score

- Loan amount and tenure

- Type of property (ready-to-move or under-construction)

- Income and employment stability

- Bank or lender policies

Check All Banks Home Loan Interest Rates in Dehradun – 2025

Home Loan Interest Rates for All Banks 2025:

| Name of the Bank | Interest Rate | Processing Fee |

|---|---|---|

| Bank of Baroda | 8.65% to 10.35% p.a. | 100% waiver on processing fees |

| ICICI Bank Limited | 9.25% to 10.05% p.a. | 0.50% of the loan amount plus applicable taxes |

| HDFC Bank | 8.70% to 9.95% p.a. | Up to 1.50% of the loan amount |

| Axis Bank | 8.75% to 12.70% p.a. | Up to 1.00% of the loan amount or Rs.10,000 (whichever is higher) |

| Punjab National Bank | 8.15% to 11.50% p.a. | 0.35% (Min Rs.2,500 and Max Rs.15,000) |

| State Bank of India | 8.25% to 11.30% p.a. | 0.50% of the loan amount |

| Kotak Mahindra Bank Limited | Starting from 8.65% p.a. | 0.50% to 1% of the loan amount |

| Union Bank of India | 8.10% to 12.65% p.a. | 0.50% of the loan amount |

| Central Bank of India | 8.10% to 9.75% p.a. | Waived till 31.03.2025 |

| Bank of India | 8.40% to 10.85% p.a. | 0.25% to 0.50% of the loan amount |

| Yes Bank | 9.00% to 12.00% p.a. | 1.5% of the loan amount or Rs.10,000, whichever is higher |

| IDBI Bank | 8.40% to 12.65% p.a. | Rs.2,500 to 1% of the loan amount |

| HSBC Bank | Starting from 8.75% p.a. | % of the sanctioned loan amount or Rs.10,000, whichever is higher |

| IDFC First Bank | Starting from 8.85% p.a. | 0.25% to 3% of the loan amount |

| Punjab & Sind Bank | 8.30% to 9.20% p.a. | 0.15% to 0.25% of the loan amount |

| Canara Bank | 8.15% to 11.00% p.a. | 0.50% of the loan amount (Min Rs.1,500, Max Rs.10,000) |

| Indian Bank | 8.15% to 10.15% p.a. | 0.20% to 1.00% of the loan amount |

| IndusInd Bank | 8.35% to 11.67% p.a. | Up to 1.00% of the loan amount |

| UCO Bank | 8.15% to 11.35% p.a. | 0.10% to 0.25% of the loan amount |

| Indian Overseas Bank | 7.90% to 8.50% p.a. | Contact the bank branch |

| Bank of Maharashtra | 8.10% to 10.65% p.a. | 0.25% of the loan amount |

| Bandhan Bank | 8.91% to 13.08% p.a. | Up to 1% of the loan amount |

| Karur Vysya Bank | 8.45% to 11.40% p.a. | Rs.2,500 to Rs.7,500 |

Note: Interest rates as of 26 June 2025 & rates may vary based on applicant profile.

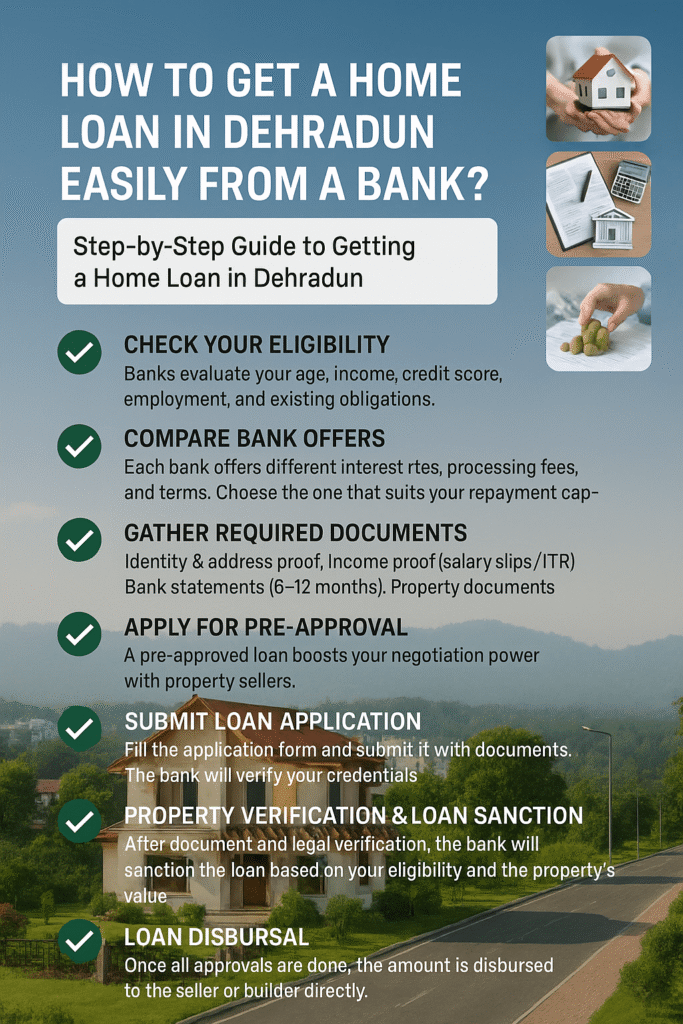

How to Get a Home Loan in Dehradun Easily from a Bank and NBFC 2025

Step-by-Step Guide to Getting a Home Loan in Dehradun:

1. Check Your Eligibility

Banks evaluate your age, income, credit score, employment, and existing obligations. A CIBIL score of 700+ is usually preferred.

2. Compare Bank Offers

Each bank offers different interest rates, processing fees, and terms. Choose the one that suits your repayment capacity.

3. Gather Required Documents

- Identity & address proof

- Income proof (salary slips/ITR)

- Bank statements (6–12 months)

- Property documents

Note: Document requirements may vary. Please consult your loan agent or bank first.

4. Apply for Pre-Approval

A pre-approved loan boosts your negotiation power with property sellers.

5. Submit Loan Application

Fill the application form and submit it with documents. The bank will verify your credentials.

6. Property Verification & Loan Sanction

After document and legal verification, the bank will sanction the loan based on your eligibility and the property’s value.

7. Home Loan Disbursal

Once all approvals are done, the amount is disbursed to the seller or builder directly.

Choose Loan Agent or Broker In Dehradun

Finding the right lender can be time-consuming and confusing. That’s where home loan agents in Dehradun come in. They:

- Help you compare multiple banks and NBFCs

- Provide personalized loan solutions

- Assist with faster approvals and minimum documentation

- Negotiate better interest rates on your behalf

Benefits of Working with Home Loan Agents in Dehradun:

- Expert Guidance: Choose the most suitable loan option.

- Time-Saving: They handle all paperwork and bank coordination.

- Better Rates: Access exclusive deals and lower interest rates.

- End-to-End Support: From application to loan disbursal.

Tips to Get the Lowest Home Loan Interest Rates in Dehradun

- Maintain a Good CIBIL Score (700+).

- Compare offers from multiple lenders.

- Choose a shorter loan tenure if affordable.

- Negotiate with the help of a home loan agent in Dehradun.

- Opt for a floating interest rate if market rates are declining.

Conclusion :

Whether you’re buying your first home or investing in property, getting a home loan in Dehradun with favorable terms is key to making your dream come true. By working with the best home loan agents in Dehradun, you can ensure you’re getting the cheapest home loan rates in Dehradun with the lowest interest and hassle-free processing.

If you’re ready to take the next step, connect with trusted home loan agents in Dehradun today and start building your future!

Looking to build your dream home in Dehradun?

Let us help you get the best home loan deal — fast, simple, and stress-free.

Call us today for a free consultation!

📞 +91 7417099208

📍 Based in Dehradun | Serving Uttarakhand