A home/housing loan, often known as a mortgage, is a sum of money obtained by an individual from a bank or other lending institution. The borrower must repay the loan amount plus interest in Easy Monthly Installments, or EMIs, over a period of time that can range from 10 to 30 years, depending on the loan type.

It is not unusual to see people choose for various types of loans for nearly any requirement these days. The majority of loans are regarded as liabilities. After taking out a loan, a borrower must reduce even everyday spending, and most of the time, the repeating EMI must be taken with a grain of salt. Even for goods that one cannot live without, one must set aside a shoestring budget after taking out any loan. A Home Loan, on the other hand, cannot be compared to these types of loans since buying a home is similar to investing in an asset that, in most situations, appreciates over time, making a Home Loan profitable in the long term. One can soothe oneself by keeping this in mind.

When you take out a Home Loan well ahead of time, the initial ‘sting’ of the EMI will not only become manageable, but will also give you a feeling of accomplishment when you ultimately buy a home.

Benefits:

- Tax Benefits: On both the ‘Repayment of Principal Amount’ and the ‘Repayment of Interest’ on a Home Loan, there are Tax Benefits.

- Leading to value appreciation : As the name implies, a home loan enables you to purchase a home, an asset with one of the greatest appreciation rates. You are not purchasing something that will lose value as soon as it leaves the showroom.

- There’s no need to rip your pocket: There is no lump sum payment required when applying for a Home Loan, other for the amount paid as a Down Payment to your Builder. As a result, the financial burden of paying a large payment is spread out across a number of EMIs.

- Long-term recuperation: Do not consider your home loan EMI to be a “expense.” If you own a home, you might rent it out and utilize the proceeds to pay your EMI. As a result, a Home Loan might be a winning offer for you.

- Instilling a feeling of accountability in you: When you start repaying your house loan EMIs, you keep track of the payment due date, your bank balance, and prioritize them. As a result, you acquire a sense of accountability. By preparing ahead of time, you can take advantage of the unique Home Loan benefits.

Why you should opt for a home loan?

Flexible Repayment

Home loans have an extended payback tenure, frequently surpassing ten years. This allows you to spread out your repayments over a period of time that is convenient for you. You can also pay off your loan early by making a lump-sum payment before the term finishes. Depending on the conditions of your loan, your lender may impose prepayment penalties.

Tax Benefits Asha home loan

A house loan entitles you to specific tax benefits that can save you a significant amount of money. Section 80C of the Income Tax Act of 1961 allows for tax deductions on principal repayments for residential property loans up to Rs.1 lakh.

You can also claim interest payments as a tax deduction of up to Rs.1.5 lakh. Even the processing charge you pay when you apply for a loan is considered interest, so you may deduct it from your taxable income. As a result, taking out a house loan rather than self-funding your property makes sense.

Choose the best interest rate for you

A house loan is available with either a fixed or adjustable interest rate. A fixed interest rate is established at a certain amount when you take out the loan and remains constant until the repayment period finishes. A floating interest rate swings in response to market conditions. Choose an interest rate that will be beneficial to you in the long term.

Capital appreciation that is quick

Given the high need for houses in India, real estate investment might prove to be highly profitable in the long term. Rents and construction expenses have been quickly growing in recent years, and this trend is expected to continue.

Type of Home Loans

In India, settling down has come to mean purchasing a home. In today’s hectic world, everyone fantasizes about having a lovely home where they can unwind at the end of the day. Due to rising real-estate costs, purchasing a home is likewise becoming a Herculean undertaking these days. Given that it is not a good idea to utilize all of your funds to buy a home or property, a home loan is a simple option to fund your purchase.

Banks and other housing finance institutions now provide a variety of home loan options. The demand for house loans has risen dramatically in recent years, and individuals have varying expectations when it comes to home loans. A number of banks have come up with the idea of creating different house loan programmes to cater to the needs of different parts of society. Several banks, to name a few, offer particularly designed house loans for women, agriculturalists, and loans just for the acquisition of land.

Lenders provide home loans for a number of reasons, including the purchase of a property. The following are some of the most common forms of house loans available on the market:

Loans for Land Purchase

Several banks provide land acquisition loans. Buying land is a versatile alternative; the buyer may save money and build a house as soon as his resources allow, or keep the land as an investment. Lenders such as Axis Bank are willing to finance up to 85% of the cost of the land.

Purchase of a Home Loan

The loan for the purchase of a new or pre-owned house is the most common sort of home loan. This loan is also widely available, and many institutions provide it in a variety of forms. Interest rates are either floating or fixed, and they typically range from 9.85 percent to 11.25 percent. In addition, many banks will lend up to 85% of the entire sum.

Loans for Home Construction

This financing is specifically created for persons who want to build a home according to their specifications rather than purchasing a pre-built home. The approval process for this sort of loan is unique in that it considers the cost of the land as well. When applying for a house construction loan, the most crucial requirement is that the plot be acquired within a year in order for the plot cost to be included in the loan amount. The loan amount is determined using a preliminary estimate of the building cost. The funds may be disbursed completely at once or in instalments. Schemes given by Bank of Baroda, UCO Bank, and Canara Bank are among the most popular house building loans.

Loans for House Expansion or Extension

Do you want an extra balcony or a bedroom? Not to worry, some banks also provide loans for house extension, which includes alterations to the present structure as well as the building of new rooms. The HDFC Home Extension loan and the Bank of Baroda’s house remodeling loan are prominent in this category.

Loans for Home Conversion

People who have previously taken out a home loan and purchased a property with it but wish to move to a different home can take advantage of home conversion loans. Borrowers can fund the purchase of a new property while without having to repay the prior home loan by transferring the present debt to the new home. While it is convenient, this type of house loan is also highly pricey.

Asha Home Loan Scheme by Axis Bank

The Asha Home Loan from Axis Bank gives a loan amount of up to Rs. 35 lakhs at a low interest rate. Furthermore, you may get a loan for up to 90% of the property’s worth, with 12 EMIs eliminated, extended terms, and a personalized loan depending on your banking habit. Learn more about the advantages of the Asha Home Loan in the sections below.

- Attractive Interest Rates – 10.05%

- The Asha Home Loan can be used to buy a home that is under construction, ready to move into, or for sale, as well as for repairs and extensions, self-construction, and plot plus construction.

- On house loans up to Rs. 30,00,000, get a loan equal to 90% of the property value.

- 12 EMIs waived at no extra cost if you pay your EMIs on time. At the conclusion of the fourth, eighth, and twelfth years, four EMIs are waived. Only three occasions when dues are outstanding for 30 days or more, but never for more than 90 days over the term of the house loan, should be on the repayment track record. At the time of distribution, the minimum tenure should be 20 years. Part-paying a house loan is possible as long as the loan term does not fall below 48 months (4 years).

- You may easily transfer your existing home loan to Axis Bank.

- Repayment terms of up to 30 years are available, allowing for greater eligibility.

- Depending on the area, a minimum combined income of Rs. 8,000 per month or Rs. 10,000 per month is necessary. Also, take advantage of the Credit Linked Subsidy Scheme.

Eligibility and Documents required

Asha home loan For Salaried individuals:

Individuals who have a permanent job with the government or a reputable company are eligible for a house loan.

Applicants must be over the age of 21 at the time of loan origination and under the age of 60 or superannuation at the time of loan maturity, whichever comes first. The Home Loan EMI Calculator can help you figure out how much you’ll have to pay in EMIs.

Asha home loan For Professionals:

The Axis Bank Home Loan qualifying conditions are only met by professionals (i.e., physicians, engineers, dentists, architects, chartered accountants, cost accountants, company secretary, and management consultants).

Asha home loan’s eligibility conditions are met by applicants who are above 21 years old at the time of application and under 65 years old at the time of loan maturity.

For Self Employed Individuals:

Anyone who is filing income tax returns is eligible to apply.

Applicants must be at least 21 years old at the time of the home loan’s inception and no more than 65 years old at the time of the loan’s maturity.

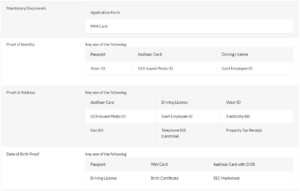

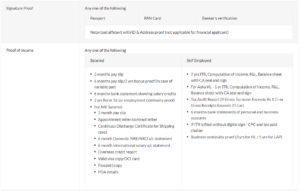

Documents Required

Apply Now : Asha Home Loan

Статья предлагает глубокий анализ темы и рассматривает ее со всех сторон.

Автор представляет различные точки зрения на проблему без предвзятости.

Temp Mail I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

Эта статья является настоящим источником вдохновения и мотивации. Она не только предоставляет информацию, но и стимулирует к дальнейшему изучению темы. Большое спасибо автору за его старания в создании такого мотивирующего контента!

Автор старается сохранить нейтральность и обеспечить читателей информацией для самостоятельного принятия решений.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Hello I am so excited I found your webpage, I

really found you by mistake, while I was researching on Digg for something else, Anyways I am here now

and would just like to say thanks for a marvelous post and a

all round entertaining blog (I also love the theme/design), I don’t have time to

read through it all at the minute but I have saved it and

also added your RSS feeds, so when I have time I will be back to read a great deal more, Please do keep up the awesome job.

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across.Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut

Everything is very open and very clear explanation of issues. was truly information.Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across.Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across.Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut

Simply desire to say your article is as surprising The clearness in your post is simply excellent and i could assume you are an expert on this subject Fine with your permission let me to grab your feed to keep up to date with forthcoming post Thanks a million and please carry on the gratifying work

Hi, just required you to know I he added your site to my Google bookmarks due to your layout. But seriously, I believe your internet site has 1 in the freshest theme I??ve came across.Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut

Thank you for content. Area rugs and online home decor store. Hello Administ . Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut

I really love to read such an excellent article. Helpful article. Hello Administ . Seo Paketi Skype: By_uMuT@KRaLBenim.Com -_- live:by_umut